Every Dollar Counts: Your Baby Savings Goal Isn’t About Perfect Numbers

When you see those two lines on a pregnancy test, a thousand emotions rush in at once. Joy, wonder, maybe a little terror – and eventually, baby savings goals quietly elbow their way into your thoughts. If you’ve started researching your baby’s costs, you’ve probably seen the numbers:

- $15,000 to $25,000 for the first year

- Hospital bills of $2,000 – $5,000

- Daycare deposits and fees of $2,000+

- Formula costs of $100 – $250 per month

If you’re like most expecting parents planning for a baby, you’re doing the mental math, wondering how the lists can go on and on, and feeling behind before you even begin. So here’s the perspective shift that changes everything:

What matters most is that you’re saving for your baby. Not the amount.

There’s a world of difference between starting parenthood with $2,000 saved and starting parenthood with nothing saved. Even $1,000 gives you options you wouldn’t otherwise have and $500 can be the difference between a setback and a spiral.

The real value of saving before baby arrives isn’t in hitting some perfect number – it’s in avoiding the cascade of compromises that happen when you start parenthood from a position of financial stress.

Saving For Your Baby Is Easier Than Catching Up

Here’s the uncomfortable truth every new parent eventually learns: The system isn’t built for you. Paid parental leave is either inadequate or nonexistent, leaving mothers and fathers to return to work before their bodies have healed, their minds have caught up, and their children have settled. Childcare costs are astronomical, often exceeding what parents pay for housing. The infrastructure that makes working parenthood manageable simply doesn’t exist for most families.

They’re not imagining it and you’re not doing the math wrong. The system is broken, and parents – especially mothers – are paying the price. And that’s before you factor in this reality:

When parents can’t afford to bridge those early years with savings, they’re forced into impossible choices that can reshape an entire financial future.

Shortfalls don’t stay abstract for long. And though financial strains touch every part of a household’s budget, childcare is often where insufficient savings become impossible to ignore. As noted by ChildCare Aware’s “Economics and Child Care” Report,” access to affordable child care remains crucial for workforce participation, particularly for mothers with younger children. It’s an important gatekeeper expense. So often, the solution of functioning without it isn’t to spend less; it’s to work less.

From there, the financial impact spreads well beyond the immediate moment.

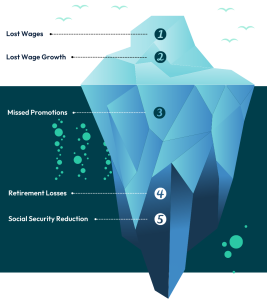

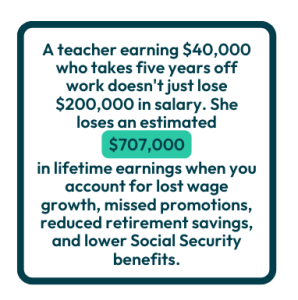

Research from the Center for American Progress shows leaving or scaling back work costs far more than the immediate income lost. According to the Center’s interactive calculator, parents who step back from work lose wage growth, promotional opportunities, retirement contributions, and Social Security benefits. That means, it costs parents three to four times their annual salary for each year they’re out of the workforce.

These long-term losses are real, but they’re largely invisible in the moment. You don’t see the promotion you would have gotten five years from now, or the retirement account that would have compounded for decades, or the Social Security benefits calculated on the earnings you never made. But their impact will be felt across decades.

And childcare isn’t the only financial choke point for working families. No paid leave in the first year of parenthood drives an early return to work and insufficient funds for household and parenting support make it difficult to keep a growing household running. These pressures are separate doors leading to the same spiral that leaves parents with no room to breathe, no choice but to step back, and no safety net beneath them.

With so many financial and logistical pressures, it’s clear why 43% of highly qualified women exit their careers entirely in the first year of parenthood, according to “The Future of Working Motherhood Report,” published by Executive Moms.

Small gaps create bigger gaps, so families that start parenthood with even modest savings make fewer financial compromises in baby’s first year, maintain career momentum better and are more likely to take their full intended parental leave and avoid high-interest debt in baby’s first year. They don’t face easier circumstances; they just have a buffer that prevents one challenge from cascading into three more. And in the first year of parenthood, that difference is everything.

The Power of Progress Over Perfection In Saving For Parenthood

So how do you actually start saving when the gap between where you are and where you “should” be feels insurmountable? You start by understanding this: Small wins create big momentum.

Don’t focus on the gap. Focus on the first step. And then the next one.

Years of behavioral economics research shows people who achieve small, meaningful financial goals experience increased confidence and are more likely to continue positive financial behaviors long-term. Saving $500 for your baby isn’t just $500; it’s proof to yourself that you can do this. It’s evidence that you’re capable of planning, sacrificing, and following through. That psychological shift matters as much as the money itself, so design your savings approach to reinforce that shift and make each small win visible and meaningful:

Explore Your Savings Path: Use StorkFund’s savings calculator to plan and see what’s possible. Small steps today lead to big opportunities tomorrow, and imagining the path forward opens the door to your financial journey.

Set Milestone Celebrations: Hit your first $500 goal? Take a modest $15-20 to splurge on something for yourself. Celebrating progress keeps you motivated.

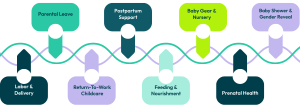

Visualize Your Progress: Instead of watching one intimidating number slowly climb, break it into smaller goals. First $500, then $1,000, then $1,500. Or organize your savings around the different ways you’ll protect and provide for your growing family:

- Labor & delivery

- Parental leave

- Return-to-work childcare

- Postpartum support / the fourth trimester

- Feeding & nourishment

- Baby gear & nursery

- Prenatal health

- Baby shower & gender reveal

Each milestone you fund is a concrete win you can see and celebrate and makes your progress feel real and achievable.

Reframe Your Setbacks: Didn’t save anything this month due to an emergency? Life happens. That’s not failure. Start again next month, and remember progress isn’t linear.

Share Your Goal: Tell one trusted person, because accountability matters. When you’re tempted to skip a transfer, knowing someone might ask about your progress helps you stick with it.

The goal isn’t perfection. It’s progress. And every dollar saved is progress.

The Gift You’re Really Giving Your Baby

You’re not just saving money. You’re creating space: Space to breathe, space to bond, space to be the parent you want to be rather than the parent financial stress forces you to be. You’re protecting your career so you can continue providing for your family long-term. You’re investing in your own wellbeing so you can show up fully for the tiny human who needs you.

That’s the real gift. And it starts with the first dollar you save today.

Your baby will be lucky to have you. Not because you have unlimited resources or a fully-funded budget, but because you’re here, right now, planning and doing the hard work of preparing.

That intentionality, that willingness to try even when the numbers feel overwhelming? That’s what makes a great parent.

StorkFund’s Designed To Helps Parents Save for Baby Expenses

You deserve tools (like StorkFund’s quick and easy Baby Financial Readiness Quiz) that meet you where you are, and not where a spreadsheet says you’re supposed to be. StorkFund was created for families like yours: Parents who want to save and budget smartly, not perfectly. Our platform helps you organize your savings around milestones that actually make a difference, not just arbitrary numbers, such as:

- quality labor and delivery care;

- adequate leave to recover and transition; and

- safe and reliable childcare,

while helping you visualize your progress and access exclusive discounts to stretch every dollar you save further. Get early access to StorkFund and join the growing number of families already building their baby funds with confidence, guidance, and a community that gets it.

We’re not here to tell you what you “should” have saved. We’re designed for real budgets – not perfect ones – and we’re here to help you save what you can, starting from wherever you are.