Every Dollar Counts: Your Baby Savings Goal Isn’t About Perfect Numbers

When you see those two lines on a pregnancy test, a thousand emotions rush in at once. Joy, wonder, maybe a little terror – and yes, probably some questions about money.

If you’ve started researching baby costs, you’ve probably seen the numbers: $15,000 to $25,000 for the first year. Hospital bills of $2,000 – $5,000. Daycare deposits and fees of $2,000+. Formula costs of $100 – $250 per month. The list goes on, and if you’re like most expecting parents, you’re doing mental math and feeling behind before you even begin.

Here’s what most articles won’t tell you:

The Amount You Save Matters Far Less Than the Fact You’re Saving At All For Your Baby.

Starting your family with $2,000 is categorically different from starting with $0.

$1,000 buys you breathing room and even $500 changes your options.

The real value of saving before baby arrives isn’t in hitting some perfect number – it’s in avoiding the cascade of compromises that happen when you start parenthood from a position of financial stress.

Saving Early For Your Baby Is Easier Than Catching Up Later

Here’s the uncomfortable truth that every new parent eventually learns: the system isn’t built for you. Paid parental leave is either inadequate or nonexistent. Childcare costs are astronomical, often exceeding what parents pay in rent. The infrastructure that would make working parenthood manageable simply doesn’t exist for most families.

You’re not imagining it. You’re not doing it wrong. The system is broken, and parents – especially mothers – pay the price.

But here’s what makes it even harder:

When you can’t afford to bridge those early years with savings, you’re forced into impossible choices that don’t just affect this year – they reshape your entire financial future.

The long-term losses are real, but they’re largely invisible in the moment. You don’t see the promotion you would have gotten five years from now, or the retirement account that would have compounded for decades, or the Social Security benefits calculated on earnings you never made.

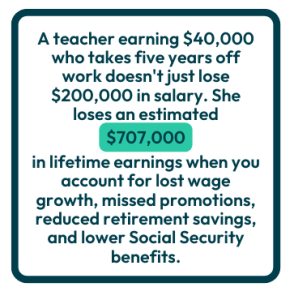

Research from the Center for American Progress found that taking time out of the workforce costs far more than lost paychecks. As their interactive calculator shows, you lose wage growth, promotional opportunities, retirement contributions, and Social Security benefits. That means, it costs you three to four times your annual salary for each year you’re out.

This is the trap: Childcare costs and early financial strain may be concentrated in a few brutal years when your children are young, but the consequences of the choices you’re forced to make spread across decades of your life. Here’s what that looks like:

Financial stress doesn’t just cost you money; it costs you choices. And in the early months of parenthood, those choices have long-term consequences that most people don’t see coming.

The Childcare Scramble: Without savings to cover those first crucial months of childcare costs, one parent’s entire paycheck often goes to securing childcare – making it feel pointless for one parent (often the mother) to keep working. So they leave “temporarily,” planning to return in a year or two or five. But skills atrophy, professional networks fade, and re-entry means returning to work several rungs lower on the career ladder. What was supposed to be a one-year break becomes a permanent reduction in lifetime earnings, according to the Center for American Progress and their interactive calculator.

The Leave Compromise: Without a financial cushion, many parents return to work earlier than planned. Coming back before you’re physically and emotionally ready means you’re not performing at your best, which affects performance reviews, raises, and promotional opportunities. This is one reason why 43% of highly qualified women leave their careers entirely within the first year of parenthood; they return too early, struggle to manage, and opt out rather than continuing to perform under high and unfair levels of stress. What starts as cutting leave by two weeks can easily end with abruptly leaving your career.

The Flexibility Trap: Parents without savings may take lower-paying roles because they offer schedule flexibility to cover childcare gaps. A $10,000 salary cut to get “flexible hours” seems reasonable in year one. But over five years? That’s $150,000+ in lost earnings, raises, retirement contributions, and career advancement opportunities. According to the Center for American Progress and their interactive calculator, you lose out on far more than just your annual salary when you leave the workforce to care for your children.

The compound effect: Once you’re behind – earning less and/or paying more than you’d originally planned – each financial decision creates another compromise. Small gaps create bigger gaps, so families that start parenthood with even modest savings make fewer financial compromises in baby’s first year, maintain career momentum better and are more likely to take their full intended parental leave and avoid high-interest debt in baby’s first year. They don’t face easier circumstances; they just have a buffer that prevents one challenge from cascading into three more.

This is why saving anything before baby arrives matters so much. Whether it’s $500 or $5,000, you’re not just building a cushion—you’re preventing the spiral. And in the first year of parenthood, that difference is everything. It compounds over months and years into dramatically different financial trajectories for you and your little one.